On 16-17 November, EmpowerRD exhibited at The Business Show, and it did not disappoint. With hundreds of companies in attendance, we had the chance to meet and chat with some of the UK’s most innovative businesses. Here are our three key takeaways from the show:

1. High fees & low scheme knowledge

The R&D tax credit scheme has seen much growth in recent years, with more businesses claiming and more advisors entering the market. We were disappointed to learn that so many companies are still being overcharged or misled by underhanded advisors.

After talking with several visitors at the show, it became apparent that their current providers were charging around the 20% mark.We believe that an acceptable market rate for an SME R&D tax claim is anything below 10% of your claim value. Anything above that unnecessarily exceeds the cost profile of making a claim.

We also spoke to a number of businesses whose service providers had given them inaccurate information about whether they could claim. It’s no wonder HMRC has increased its anti-abuse task force and put more measures in place to stop fraud and misuse of the scheme.

Here at EmpowerRD, we pride ourselves on charging a maximum of only 5% the value of your R&D tax credit for SME claims – nothing more. Furthermore, our team includes ex-HMRC officials and skilled advisors who submit an average of three claims per day. We specialise exclusively in R&D tax credits to ensure that you receive the best possible service.

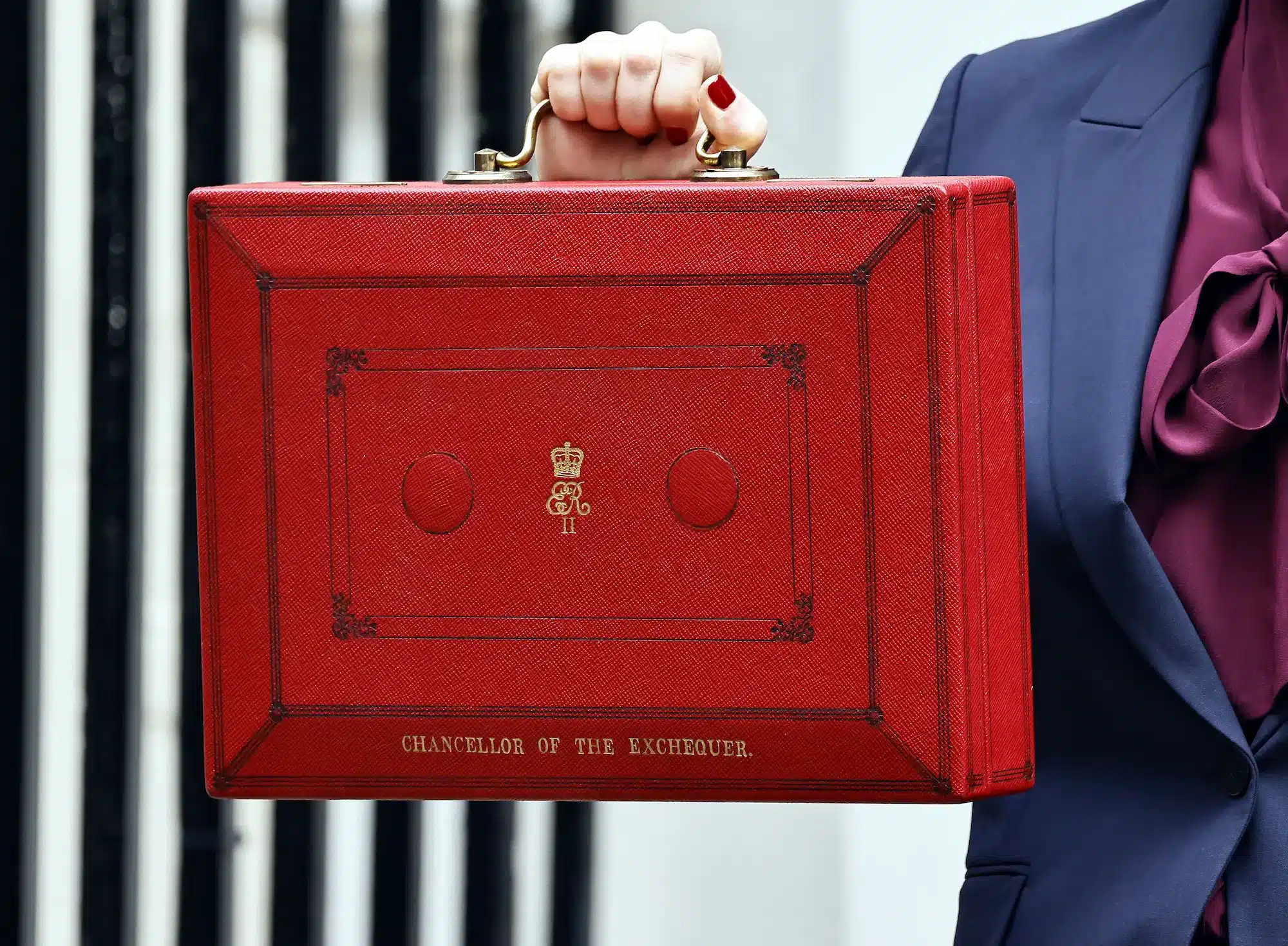

2. The Autumn Statement made businesses feel uneasy

Many people we spoke to at the show felt very anxious about the potential changes to the R&D scheme announced in the Autumn Statement. Some of these changes were positive, while others were tougher to stomach.

3. Innovation is still worth investing in

With the government committed to investing £20 billion in research and development by 2024/25, it’s clear that they believe innovation is key to UK growth and recovery. This sentiment was echoed by many of the businesses present at the show.

Investing in new innovative products and services differentiate your company from others in the market and allow you to show your true potential. Introducing new innovations can lead to a wider customer base, additional revenue stream, and more profitability. Without innovation, you can stagnate, even your current and potential customers want something new that meets their needs in a better way.

Seeking a trusted partner to help you build your R&D tax claim?

We’re here to help. Over 900 UK companies have trusted EmpowerRD’s R&D platform and specialists to help them build optimised, compliant R&D tax claims.

Book a call with one of our team to see how we can help you.