Last Call for R&D Tax Claims: Get Ready for Big Changes in August!

August 2023 – The deadline for your R&D tax credit claim is approaching The August 2023 deadline for submitting your amended CT600 (Corporation Tax return)

An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a Meeting

August 2023 – The deadline for your R&D tax credit claim is approaching The August 2023 deadline for submitting your amended CT600 (Corporation Tax return)

Starting from 8 August 2023, there are important changes to filing an R&D claim. Companies must now submit an Additional Information Form as supporting evidence

There is no excerpt because this is a protected post.

There is no excerpt because this is a protected post.

From 1 August 2023, the process of filing an R&D claim is changing. HMRC require that all companies submit an Additional Information Form as supporting evidence for

If you’ve been operating for over five years and are now experiencing substantial growth, you’ve hit a milestone. At this point, securing proper funding is

In the UK tech industry, intellectual property is critical for startups to protect their innovations and differentiate themselves from competitors. Developing an IP strategy can

Today is World Creativity and Innovation Day, an excellent opportunity to recognise the importance of innovation. Here at EmpowerRD, we know first-hand how critical innovation

Want to know how the UK’s innovation activity and global industrial performance compare to other countries? The Cambridge Industrial Innovation Policy annual UK innovation Report

From 1 April 2023, the R&D tax relief scheme is undergoing drastic changes. To help you understand what these changes mean for your company’s future

An update from our Chief Client Officer, Max Glennon, on the latest changes affecting the UK’s R&D tax credit scheme. This month: Max looks

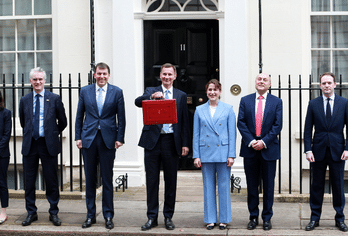

Chancellor Jeremy Hunt’s Spring Budget 2023 supports the government’s economic plan to halve inflation, reduce debt and grow the economy. Highlighting the government’s commitment to

"The online platform made it much easier to co-ordinate between the finance and technical teams."

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

© Copyright. EmpowerRD. CN 10785149. VAT GB 271357893. All Rights Reserved. Registered office: 5th Floor, Holden House, 57 Rathbone Place, London W1T 1JU.