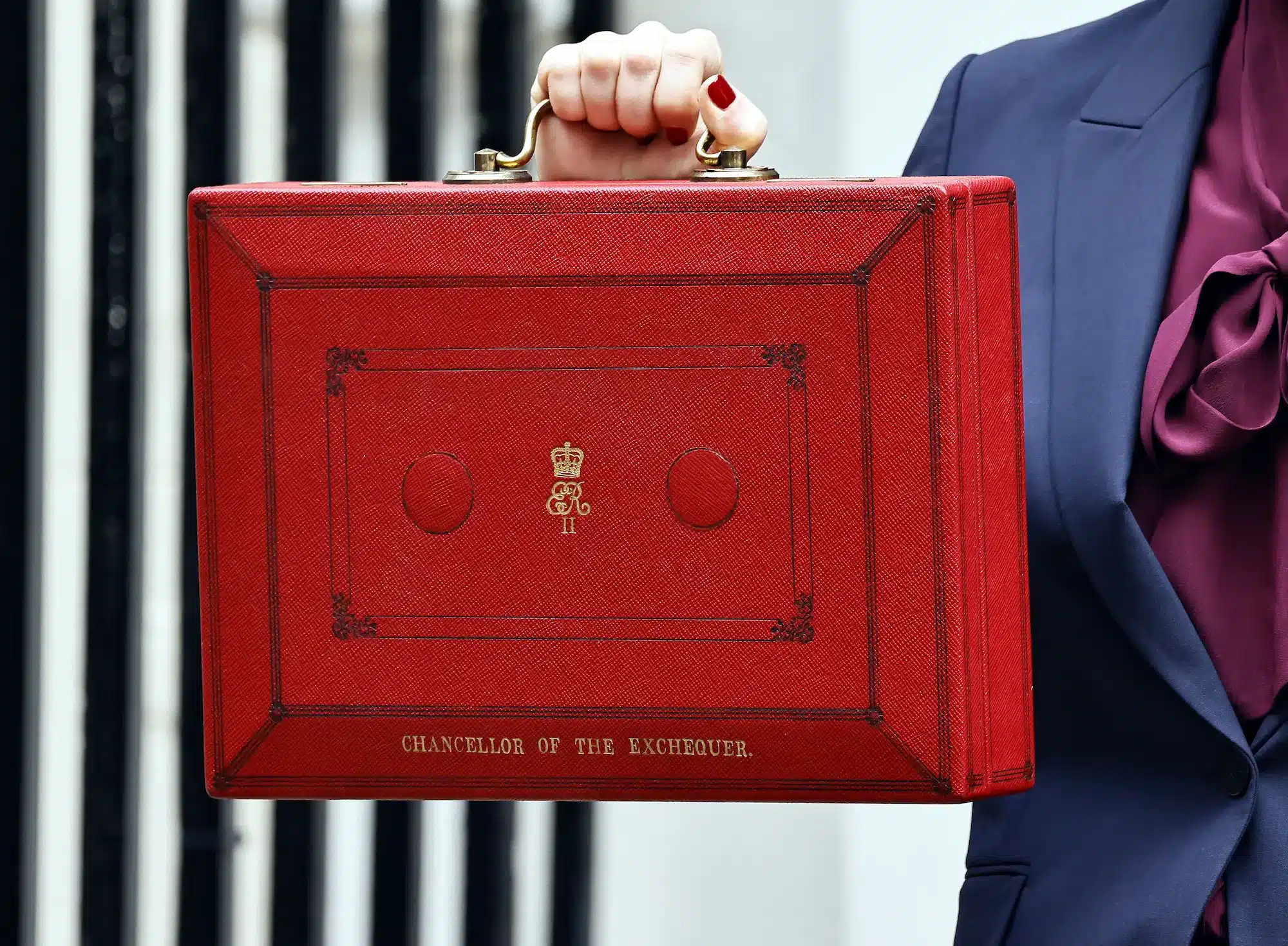

The news surrounding the £22bn “black hole” in the public finances has been impossible to avoid over the past few months, and it’s this shortfall, along with rising debt and a heavy tax burden, which is set to define Labour’s first Autumn Budget. Rachel Reeves faces the challenge of tackling these fiscal issues while also devising policies to bring confidence and economic growth.

Across the UK, startups will be watching closely, as policy decisions on capital investment and taxation could have significant impacts. While this year’s Autumn Budget isn’t expected to bring drastic changes to R&D tax relief, a relief after so much change in recent years, areas like capital allowances, business rates, and capital gains tax could take the spotlight.

Here’s a roundup of what our experts at EmpowerRD predict…

Business Tax Predictions

Clarity on the business tax roadmap

In the upcoming budget, Labour will likely provide clarity on their plan to provide businesses with a tax roadmap, which aims to offer long-term guidance for companies navigating tax policies.

A key point is the pledge to cap the headline corporation tax rate at 25% for the duration of this parliament, which should reassure most companies. However, there is still no mention of the small profits rate—a lower tier of corporation tax. While no increases are expected, gaining clarity here would be beneficial for smaller businesses.

Labour also plans to retain full expensing, allowing businesses to deduct 100% of capital expenditure in the year it’s incurred. This is expected to continue under the new government, helping innovative companies manage cash flow and reinvest more quickly into new projects and technology.

We also anticipate that the business tax roadmap will provide further guidance on capital allowances, reliefs, and long-term tax planning. For companies with significant investments in R&D and infrastructure, this roadmap could be particularly beneficial, allowing them to better prepare for future tax implications.

Employer National Insurance on Pension Contributions

In a new twist in Labour’s tax plans, there’s talk of introducing National Insurance (NI) on employer pension contributions. This move is set to bring in £17 billion a year, all while steering clear of directly taxing employees.

What does this entail? Employers might soon have to chip in NI on the pension contributions they make for their staff. It’s an interesting workaround that keeps Labour’s promise not to hike up NI for workers, shifting the focus to businesses instead.

For most companies, especially those with strong pension schemes, this could mean seeing an increase in operating costs. It’s something to keep an eye on and plan for, as these changes could have a big impact.

Business rates reform

Labour’s manifesto also suggests that we might see reforms to business rates in the upcoming budget, with a focus on levelling the playing field between high-street retailers and online businesses.

These reforms are expected to benefit traditional brick-and-mortar businesses by easing the tax burden that has long been a point of contention for SMEs, particularly in retail, hospitality and other sectors with physical footprints.

Proposals could include adjustments to Small Business Rate Relief (SBRR) and reforms to address empty property rates relief to help businesses better manage property costs. For companies that maintain offices, labs, or manufacturing facilities, these changes could bring some financial relief, especially for those facing rising rent and energy bills.

While it seems the broader focus is on high-street renewal, innovative companies with physical locations might see indirect benefits from any overall reduction in the business rates burden, helping them better allocate resources toward innovation and growth.

Innovation and R&D Tax Relief

Stability in R&D Tax Relief

Despite some chatter and negative press about the R&D tax credit scheme, the Autumn Budget is not anticipated to bring major changes to R&D tax relief. This relief remains vital for fostering innovation across the UK. Many companies in technology, life sciences, and manufacturing rely on R&D tax credits to drive growth and creativity.

Labour has committed to maintaining the scheme’s stability, reassuring businesses that have adjusted to recent reforms. At the recent R&D Communication Forum (RDCF), it was clear that ministers are getting up to speed on the scheme and are collaborating with HMRC, highlighting the priority given to R&D reliefs. On October 7th, just weeks before the budget, James Murray, Exchequer Secretary to the Treasury, reaffirmed the government’s dedication, stating, “The UK’s R&D tax reliefs play a crucial role in supporting innovation and economic growth.”

Labour may also elaborate on how it plans to implement the initiatives outlined in their Business Partnership for Growth prospectus. They expressed a desire to evaluate the R&D tax relief scheme by sector, starting with life sciences, to identify where it performs effectively and where improvements are needed, ensuring the tax credits provide maximum benefit while reducing fraud and errors.

Green innovation support

Aligned with the government’s net-zero targets, the budget is likely to offer new or expanded incentives for green technology and sustainability initiatives. Companies engaged in carbon reduction, renewable energy, or sustainable technologies might benefit from reliefs, enhanced capital allowances or new grants designed to boost environmentally friendly innovation.

For those focused on green tech, these incentives provide a chance to align with government-supported projects, facilitating funding for ventures that advance the UK’s environmental objectives.

Personal Tax Predictions

Capital Gains Tax (CGT)

Changes to Capital Gains Tax (CGT) are widely expected, with speculation that Labour might increase rates to align more closely with income tax rates. This could significantly affect founders, investors, and those planning exit strategies.

There’s also the possibility that the CGT uplift on death could be removed, which currently allows beneficiaries to inherit assets without paying CGT on gains made during the original owner’s lifetime. Removing this could create a “double tax” scenario where both CGT and inheritance tax (IHT) apply to the same estate, complicating succession planning for business owners passing down assets.

Inheritance Tax (IHT) reform

Labour could also target inheritance tax (IHT) reliefs, particularly Business Relief (BR) and Agricultural Relief (AR). These reforms might increase the IHT burden on businesses passing assets to heirs, complicating succession planning for founders of innovative companies.

Reducing or capping these reliefs would mean higher tax liabilities for business assets, shares, or properties passed through inheritance, reshaping the way business owners plan for wealth transfer and the future of their companies.

Dividend Tax

Labour may also consider raising dividend tax rates, which are currently lower than the income tax rate, impacting business owners who pay themselves through dividends. This shift could reduce the financial advantages of dividend compensation, potentially leading businesses to rethink their payroll and owner compensation structures.

Last thoughts…

The Autumn Budget 2024 is poised to introduce significant changes that could greatly impact innovative companies and startups across the UK.

While there are positives concerning corporation tax, R&D relief, and other growth initiatives, potential shifts in CGT, IHT, and dividend tax might present new challenges. Staying informed and adaptable is crucial in navigating this evolving fiscal landscape, so mark your calendars for October 30th to catch the budget announcements.

If you like what you’ve read, our team of experts will provide their analysis once the budget announcements are finalised. Subscribe to our newsletter to receive their insights directly in your inbox.