An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThe EmpowerRD Blog

Insights and ideas to enrich your innovation, navigate the complex funding landscape, and enhance the quality of your R&D tax credit claims.

Missed your R&D claim notification? HMRC offers a lifeline

Spring Statement 2025: Key takeaways for innovative companies

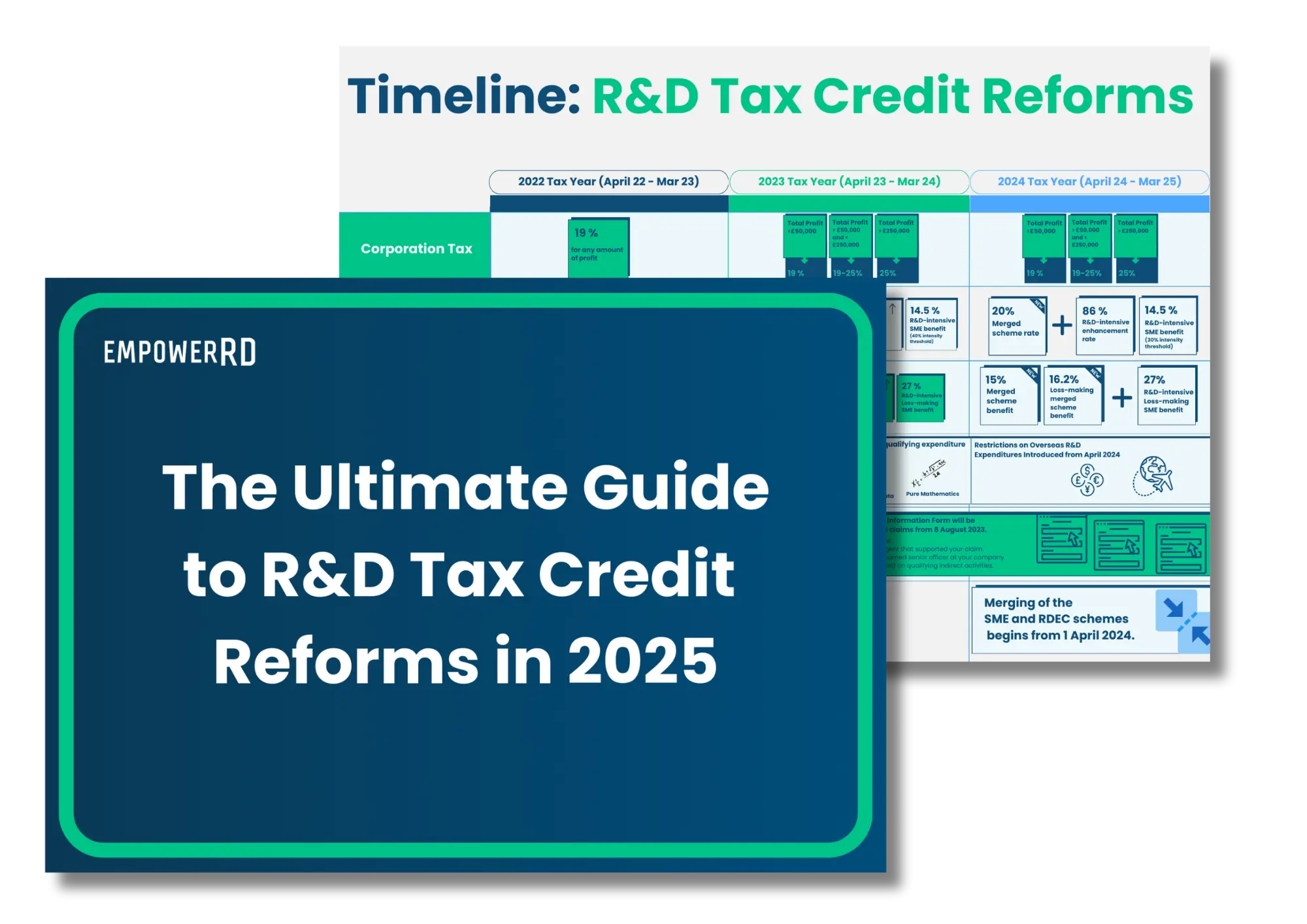

Recent R&D tax relief scheme changes require understanding to ensure future claims are successful.

Latest posts

R&D tax credit statistics 2024: Navigating compliance and new realities

The R&D tax relief landscape has undergone significant reforms recently, as evidenced by HMRC’s latest 2022-23 tax year statistics. For the first time since the

Update on Research and Development Communication Forum (RDCF): September 2024

Last week, we attended the RDCF meeting and have distilled it into key insights for you, saving you from a lengthy three-hour session! The meeting

Why HMRC’s increased scrutiny of R&D Tax Credits is good for businesses and public finances

Relying on your R&D efforts to speak for themselves won’t cut it Recently, a wave of headlines has spotlighted the state of R&D tax credits

Why EmpowerRD charges 5% or less of the final claim value

It’s felt like a rollercoaster ride over the past few years in the world of R&D tax credits. We’ve had a host of reforms to

Encouraging progress in HMRC’s R&D tax credit compliance efforts

According to HMRC’s latest Annual Report and Accounts for 2023-24, there’s some good news: the error and fraud rate for the R&D tax relief scheme

7 ways to legitimately reduce your Corporation Tax Bill

With the Corporation tax rate increasing from 19% to 25% in April 2023, more companies are feeling the squeeze each month. Combined with rising costs

Talk to an expert

Our clients say

"The online platform made it much easier to co-ordinate between the finance and technical teams."

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

Join our newsletter

Stay informed

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Useful Links

© Copyright 2025. EmpowerRD. CN 10785149. VAT GB 271357893. All Rights Reserved. Registered office: 5th Floor, Holden House, 57 Rathbone Place, London W1T 1JU.