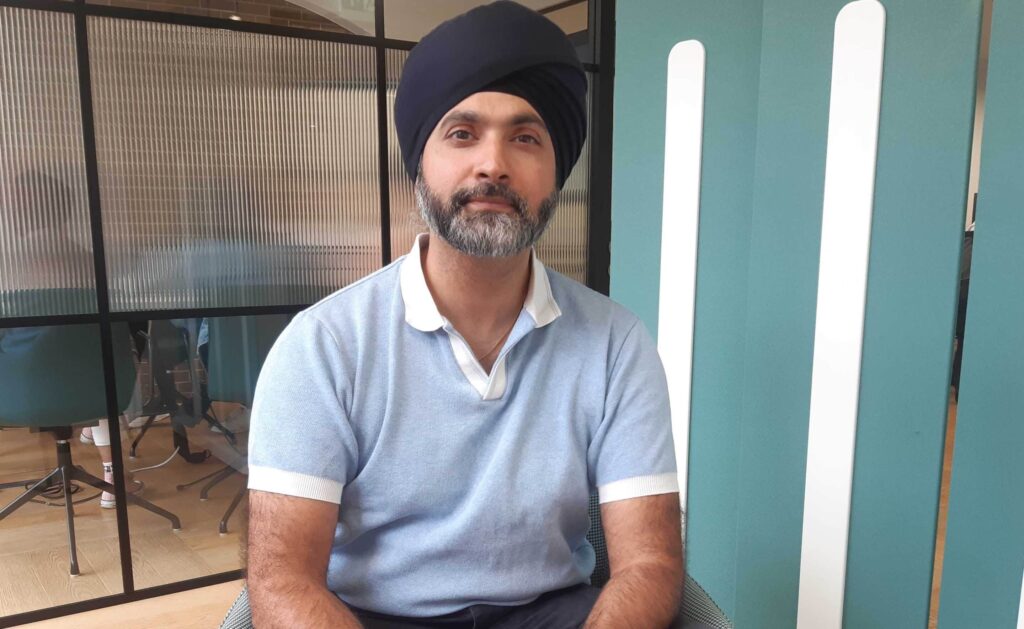

This week, we had a coffee chat with our founder, Hari, to discuss the present and future of R&D tax relief.

Hari shares insights on the evolving R&D tax relief landscape, the impact of the new Additional Information Form, EmpowerRD’s proactive approach to upcoming changes, and his vision for the future of R&D tax relief.

Let’s get into it!

So Hari, how has the R&D tax credit claims landscape evolved since you first started EmpowedRD? Have you noticed any significant changes in the industry?

Lately, there’s been a lot more pressure from HMRC on advisors to step up their game when it comes to the quality of R&D tax credit claims. At the same time, there’s this downward pressure on the fees being charged by advisors.

This situation is forcing advisors to think outside the box and invest in new processes and engagement structures between claimants and advisors. We’ve got to find ways to deliver better results while keeping costs down.

One thing that’s becoming increasingly important is investing in bespoke, relevant and robust technologies. They’re no longer a luxury; they’re becoming the norm for us to operate effectively. We need these tools to provide tailored solutions and ensure claims are compliant and optimised. It’s table stakes now.

Essentially, the industry is feeling the pressure to up its game, but we also see the value in investing in the right tools and processes.

“The Industry is feeling the pressure to up it’s game.”

What do you think are the biggest challenges we face today when it comes to R&D tax credits claims?

When it comes to working with HMRC and our clients, our main focus is on providing a high level of assurance. We want to ensure that HMRC feels confident in the claims we submit while also making the process as smooth and hassle-free as possible for our clients.

We understand the importance of collating and presenting information robustly and timely. It’s all about making sure our clients have a solid case to support their claims. We want to minimise any friction and ensure that everything is in order when it comes to the documentation and evidence we provide.

And you know what? We’ve also taken steps to “HMRC-proof” the claimant’s experience. We want to shield our clients from any unpredictable actions or changes HMRC might make. We strive to maintain a level of stability that has been prevalent in the R&D relief space for a long time.

“We’ve also taken steps to ‘HMRC-proof’ the claimant’s experience. We want to shield our clients from any unpredictable actions or changes HMRC might make.”

Of course, HMRC has been experimenting with changes, and we’ve seen some actions taken by them that caused payment delays during the summer of 2022. It’s been challenging, but we’ve learned from it and adapted our strategies to mitigate potential risks or issues.

At the end of the day, our goal is to provide a seamless experience for our clients while ensuring that their claims are solid and reliable. We’re committed to navigating the ever-evolving landscape and providing our clients with stability and peace of mind.

How has EmpowerRD adapted to the recent reforms within the R&D tax relief scheme, especially the significant changes that took place in April 2023? And how have these changes affected your clients?

At EmpowerRD, we’ve been fortunate to have made substantial investments over the past six years in areas that HMRC is now prioritising for greater robustness. As a result, many of our technologies and processes have naturally evolved to address these specific areas. They are more of an evolution of the design principles we have been operating under rather than a drastic revolution experienced by many others in the industry.

Our clients have already noticed and will continue to observe a more comprehensive and auditable approach in our R&D project methodology. We have implemented more granular cost-tracking, enabling us to present a stronger and more defensible claim to HMRC.

We acknowledge the privilege of being well-prepared in these targeted areas. Our strategic investments have allowed us to adapt smoothly and stay ahead of the curve. The satisfaction of our clients is a testament to the value we bring through our continuous improvement efforts.

I heard there’s a new additional information form coming in August. How do you think this will impact businesses?

First off, this new form aims to establish clearer linkages between R&D activities and costs. It’s all about ensuring that businesses can provide a solid connection between the work they’re doing and the expenses they’re claiming.

Another thing to note is that this form provides a stronger opportunity for data collection and analysis by HMRC. They want to differentiate the good claims and claimants from the bad ones. So, it’s a way for HMRC to dive deeper and assess the validity of the claims.

But here’s the interesting part. As more and more data collection in the industry is being done digitally, this new form should actually enhance the quality of submissions. It’s a chance for businesses to leverage digital tools and systems to provide more accurate and detailed information. It can also potentially lead to an increase in the level of investment the Chancellor makes into the R&D scheme.

So, this new additional information form is definitely something to pay attention to. It’s all about ensuring businesses can demonstrate the link between their activities and costs while giving HMRC a better tool to assess claims. And if it leads to more investment in R&D, that’s a win-win situation for everyone.

“This new additional information form is definitely something to pay attention to. It’s all about ensuring business can demonstrate the link between their activities and costs while giving HMRC a better tool to access claims.”

How has EmpowerRD proactively prepared for the implementation of the upcoming Additional Information Form?

When we got wind of the new Additional Information Form, EmpowerRD sprang into action. We knew adjustments to our operations were necessary. Luckily, our existing procedures already had a good alignment with the new requirements. However, our dedicated tech and tax teams put in the hard work to ensure that our software and services are fully equipped for this new approach.

Behind the scenes, we’ve been working tirelessly to ensure our client’s claims remain compliant and optimised by the time August 8, 2023, rolls around. Providing them with peace of mind is our top priority. Rest assured, we’re confident that our software and services are up to the task.

Have you had any discussions with other R&D specialist providers regarding the upcoming form implementation in August? What’s the general sentiment among them?

Well, to be honest, there are still some niggles with HMRC’s forms and formats that need to be ironed out. I’ve had conversations with some other R&D specialists, and we’ve shared our concerns and questions.

However, we are optimistic that the upcoming RDCF (Research and Development Claims Forum) will address the questions and issues we have. This forum should provide clarity and guidance for us, which is a step in the right direction.

Nevertheless, we do expect that it may take 6 to 12 months for the changes mandated by HMRC to settle fully. It’s important to allow some time for adjustment. However, we are prepared to handle any challenges, including the implementation of the all-in-one RDEC scheme.

From your perspective, do you support the new changes in the R&D tax relief scheme? What are your reasons for supporting or not supporting them?

100%, Speaking from my perspective, I fully support the new changes in the R&D tax relief scheme.

First and foremost, these changes align with our worldview and philosophy. We believe that it’s essential to have more robust claims, ones that not only have a value for the claim itself but the right value. It’s about accuracy and ensuring that the claims reflect the true nature of the R&D activities being undertaken. That’s paramount in our book.

Moreover, the standardisation of data collection and sharing with HMRC is a game-changer. It’s essentially shining a spotlight on the behaviours of advisors and claimants, distinguishing between good, correct practices and those that may be incorrect. This greater visibility allows for accountability and transparency, which are crucial in maintaining the integrity of the scheme.

And you know what’s great about this? It creates a positive spiral of investment and changes within the realm of UK R&D. When we have a clearer picture of what’s working and what’s not, it opens up opportunities for improvement. It encourages advisors and claimants to strive for excellence and continuously enhance their practices. Ultimately, it’s a win-win situation for everyone involved.

Do you think accountants will seek the assistance of specialist R&D advisors to navigate the recent reforms? Why or why not?

Absolutely! You know, it’s becoming increasingly evident that the days of simply plugging in a number into a tax return and hitting submit are long gone. With the recent reforms and the more specialised process set up by HMRC, it’s clear that there’s a need for collaboration between accountants and specialist R&D advisors.

The new landscape calls for a different approach, one that leverages the strengths of both parties. Accountants bring their expertise in overall financial management and tax compliance, while specialist R&D advisors offer their deep knowledge and experience in navigating the intricacies of R&D tax relief.

In your opinion, will R&D providers who leverage technology be better equipped to tackle the challenges presented by these reforms? What are your thoughts on this?

You know, in my opinion, R&D providers who embrace and leverage technology are going to be in a much better position to tackle the challenges presented by these reforms. By harnessing the power of technology, these providers can streamline their processes, improve efficiency, and ensure accuracy in their submissions.

What do you think the future holds for R&D tax relief? Any predictions or thoughts on where it’s headed?

I believe we’ll see a move towards a unified RDEC (Research and Development Expenditure Credit) scheme. This means bringing together the different schemes under one umbrella, simplifying the process and making it more accessible for businesses. It’s all about streamlining and creating a cohesive approach.

Additionally, I anticipate a higher rate of relief for R&D-intensive companies. As the value of research and innovation becomes even more recognised, the government may offer increased incentives to encourage and support those companies that are truly pushing the boundaries of R&D.

Seeking a trusted partner to help you build your R&D tax claim?

We’re here to help. Over 1000 UK companies have trusted EmpowerRD’s R&D platform and specialists to help them build optimised, compliant R&D tax claims. Please get in touch with one of our experts today if you have any further questions.