Want to know what’s in store for R&D in 2025? Our leadership team at EmpowerRD shares their expert predictions on the trends that will shape the future of innovation. From AI’s growing influence to navigating HMRC’s evolving guidelines, we’ve got you covered.

Robert Whiteside, CEO

Rob has over 25 years of experience in scaling tech-enabled businesses. His expertise in driving growth and operational efficiency has shaped EmpowerRD’s strategic direction.

Economic outlook and competition

The economic outlook will influence spending and risk-taking in the UK compared to other regions. Factors like rising staffing costs, taxes, inflation, and limited access to capital are making these challenges even harder to navigate.

Staying ahead in a competitive landscape

As new technologies like AI emerge rapidly, many companies will need to increase their R&D efforts to stay at the forefront of innovation.

R&D claims providers

As more companies struggle to build robust R&D claims or get them properly supported, the need for trusted R&D advisors will grow. In 2025, we expect many companies to refresh their approach to claiming, looking for proven partners who can provide the expertise and confidence in a complex and changing landscape.

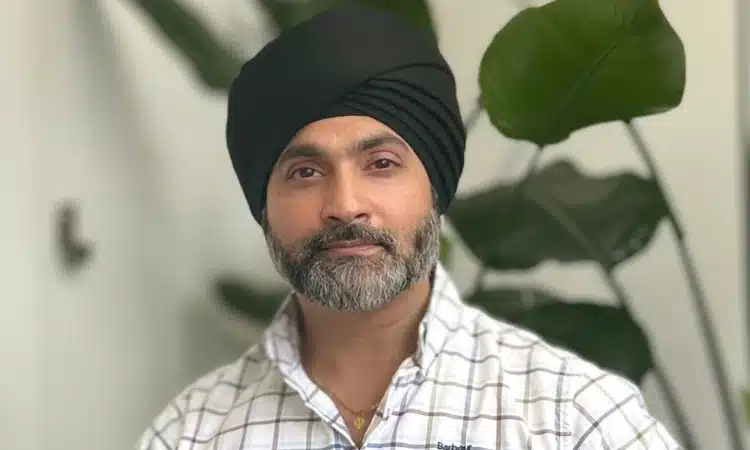

Hari Sandhu, Executive Chair

With a background in government incentives, Hari has held leadership roles at Hewlett-Packard and PwC. His deep understanding of tech and regulatory environments led him to found EmpowerRD and revolutionise the R&D claims space.

Government focus on innovation for growth

The UK government’s focus on growth through innovation will be key for R&D tax credits. But with a -0.1% GDP growth rate at the end of 2024, it will be interesting to see how the government responds. Its delivery of the industrial strategy to boost confidence and investment will be a big factor in shaping the sector.

HMRC’s R&D rules

HMRC seems to be refining its R&D criteria through enquiry activities that have progressed to tribunals. However, Judges have pushed back in cases, particularly around subcontracting conditions. This could result in HMRC clarifying its stance through updated legislation and guidance or, more likely, accepting the historically more generous interpretation. The outcomes of tribunal cases this year will provide valuable insight.

Consolidation in the R&D advisory market

Expect consolidation in the R&D funding and advisory market. After years of unchecked growth and loose operating models, 2023 marked the beginning of change, driven largely by HMRC’s regulatory updates. These shifts gained momentum in 2024, bringing poor advisory and claimant practices under scrutiny. In 2025, this trend is expected to continue, with further consolidation among advisors as the market adjusts to a “new normal” of stricter regulations and more informed claimants.

Francisco Calvente, Head of Finance

Fran is EmpowerRD’s Head of Finance, responsible for managing the company’s financial strategy.

Economic pressures and access to funding

By 2025, rising economic pressures will make it harder for innovative companies, especially startups and scale-ups, to access funding. With central banks keeping interest rates high, borrowing will become more expensive, putting extra strain on businesses already tight on cash. At the same time, venture capital firms are expected to become more selective, focusing on companies with proven success and strong market share. This means fewer opportunities for early-stage businesses to secure private funding. As a result, government grants and programs like R&D tax credits will play an even bigger role in helping businesses stay afloat and drive innovation.

AI and emerging technologies

AI will be key for companies to stay relevant in 2025. Companies that don’t adopt AI will fall behind as it will be a key differentiator across industries. However, barriers like skill gaps, high development costs and ethical concerns around AI – especially around data privacy and algorithmic bias – will hinder adoption. AI will also complicate R&D claims as emerging technologies will blur the line between R&D projects and non-qualifying activities under HMRC’s rules.

More scrutiny and compliance headaches

HMRC’s compliance measures will continue to impact the R&D tax credit landscape in 2025. The surge in claims from SMEs and startups has led to more fraudulent and low-quality claims so HMRC will be introducing more stringent review processes. Companies will need to provide more robust documentation to meet HMRC’s standards especially as AI-generated claims will lack the technical detail. This increased scrutiny plus higher compliance costs and delays in claim processing will put more pressure on cash-strapped businesses.

Katie Pearce, Head of Quality

Katie is EmpowerRD’s Head of Quality, with over 8 years of experience in R&D tax credits. She brings a meticulous approach to compliance and innovation, driving high standards within the company.

R&D Tax Relief Changes

The R&D tax relief changes introduced in April 2023 will continue to affect businesses in 2025. These changes brought different rates for SME and RDEC claims. With the addition of the Enhanced R&D Intensive scheme (ERIS) and the Merged R&D scheme (applying to accounting periods starting from 1st April 2024), there will soon be five schemes in operation at the same time, creating challenges for UK businesses in navigation and compliance.

Overseas R&D

The introduction of the Merged R&D Scheme is set to impact the strategic decisions of businesses heavily investing in R&D abroad. Under new HMRC stipulations, spending on overseas subcontractors and externally provided workers for R&D activities will no longer qualify for R&D tax relief. As a result, more companies are likely to turn to informed and trusted advisors to navigate these changes effectively.

AI in R&D claims

The use of AI in R&D projects and the claim process will be a big focus in 2025. While AI can speed up R&D claim processing and improve efficiency, it can also misrepresent projects if not handled properly. The government’s expected regulation of AI will impact how it’s used in R&D tax consultancy.

Kent Gowland, Head of Technology

Kent leads the engineering team at EmpowerRD, ensuring the platform is continuously updated to meet HMRC’s latest requirements and to streamline the claims process.

AI for Innovation

The rapid advancement of AI is set to significantly boost innovation in the UK by 2025. Major tech companies like Google report that AI is now responsible for writing 25% of their code, accelerating the pace of technological development. This trend positions the UK as a global leader in innovation, with companies likely to see greater returns on investment from their engineering teams. The UK will be in a great position to be a global leader, with companies seeing more return on investment in R&D.

UK-based R&D

The restrictions on overseas R&D expenditure will mean many businesses will have to shift their R&D strategies to the UK. This will enable businesses to get the most tax relief while supporting domestic innovation and talent. It’s in line with the government’s broader objective to increase investment in UK-based R&D.

Generative AI and workplace adoption

The launch of Apple Intelligence in the UK in early 2025 is set to accelerate the adoption of generative AI across industries. This rollout is expected to increase awareness of AI’s potential, limitations, and best use cases, fostering a deeper understanding of how it can transform various sectors. As generative AI becomes more embedded in workplace processes, businesses could see significant efficiency gains at all levels, streamlining operations and enhancing productivity.

By 2025, it is estimated that 25% of enterprises using generative AI will deploy AI agents to further boost decision-making and operational capabilities. This integration marks a pivotal step in leveraging AI to not only optimise workflows but also unlock new opportunities for innovation and growth. The introduction of Apple Intelligence is poised to play a key role in shaping this shift, driving advancements that could redefine the way businesses operate.

EmpowerRD can help

2025 promises to be a year of change for innovative companies, particularly when it comes to claiming R&D tax credits. At EmpowerRD, we’ve supported over 1,200 companies in securing more than £250m in relief. Whether you’re transitioning from the SME scheme or adapting to new regulations, we’re here to make the process straightforward and stress-free.

Want to chat with an R&D about your upcoming claim? Contact us today.