An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingProduct

R&D tax credit claims, made smarter

Take the pain out of building a compliant and optimised R&D claim by combining both expert human oversight and a next-gen collaboration platform.

Faster, transparent, fully supported R&D claims with fewer risks and no unnecessary costs.

We support your entire R&D claim journey

From onboarding to submission and HMRC follow-up.

Guided by experts

Our specialists ensure your claim stands up to HMRC scrutiny.

Empowered by technology

Our platform reduces time spent on admin.

Our tried and tested process

Every claim reviewed, refined, and compliant

Your claim isn’t just submitted, it’s reviewed and refined by multiple R&D experts before it goes to HMRC.

Each step is designed to reduce risk and increase accuracy, while keeping your team’s time to a minimum.

Claim Quality Team

Narrative screening

Is there enough technical detail? Any disqualifying content?

Includes PhD-qualified Writer

Technical drafting

Claim structured against BEIS and HMRC guidance

Senior Reviewer

Internal review and scoring

Scored (1–5) for clarity, strength, and risk — edits logged

ATT-qualified Consultant

Cost and financial review

Cost eligibility, reconciliation with accounts, and tax treatment

Submission Team

Final submission pack review

CT600, tax computation, AIF and CNF checked for consistency

We dig into the detail

What’s included

Getting you setup for success

Onboarding and setup

- Dedicated Claim Managers

- Structured onboarding for both finance and technical teams

- Xero integration and pre-formatted cost templates

- Optional R&D education and planning workshops

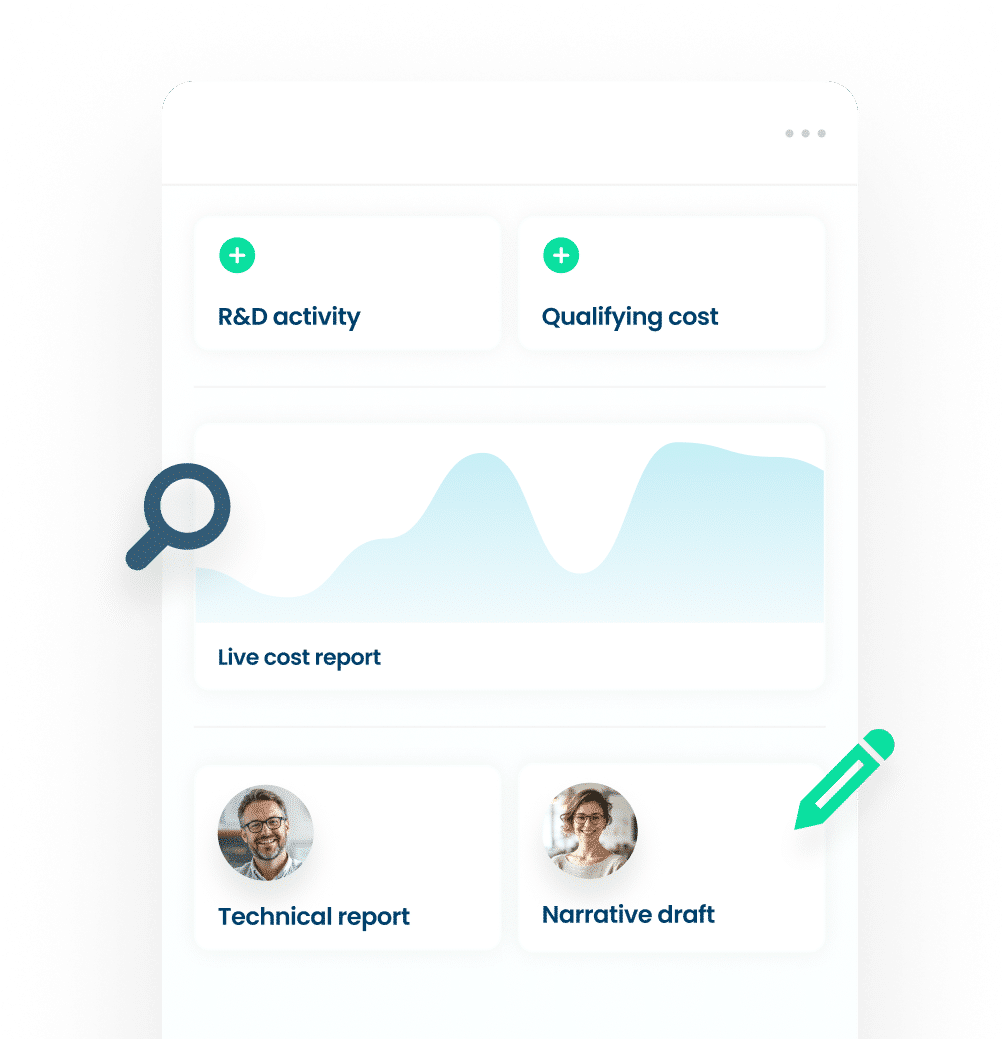

Capturing the vital information

Claim preparation

- Smart platform to log R&D activities and costs throughout the year

- Technical report drafting by PhD-qualified experts

- Narrative screening, scoring, and multi-stage review by Claim Quality Team

- Cost review and financial reconciliation against company accounts

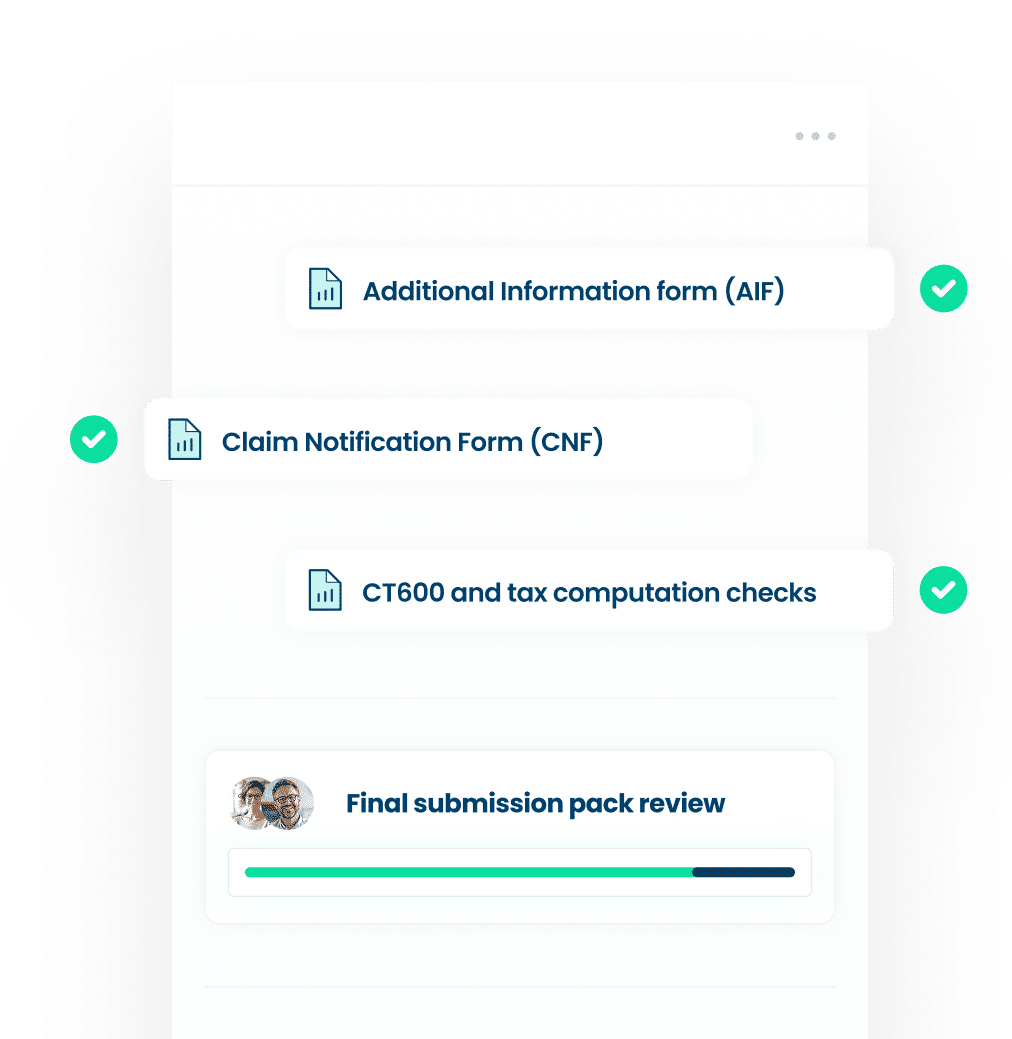

Crossing the Ts

Compliance and submission

- Preparation and submission of the Additional Information Form (AIF)

- Claim Notification Form (CNF) submission where required

- CT600 and tax computation checks

- Final submission pack review for accuracy and alignment

Post submission assurance

Ongoing support

- Full HMRC enquiry support included if needed

- Real-time notifications, status tracking, and audit trail

- Secure multi-user access with role-based permissions

- In-year forecasting and claim planning check-ins

How we measure up

Why companies choose EmpowerRD

Nothing is outsourced. Nothing is rushed. Every claim is built to stand up to scrutiny and deliver the full value you’re entitled to.

Review process

Admin burden

Technical accuracy

Cost review

Additional Information Form (AIF) and Claim Notification Form (CNF)

HMRC support

Claim visibility

Time saved

EmpowerRD

Specialist Advisor +

R&D Tech Platform

Multi-stage review by specialists

Low: platform-driven

PhD-qualified writers, ex-HMRC reviewers

Platform-supported + tax specialist input

Always included

Included at no extra charge

Full audit trail and version history

Dozens of hours per claim

Specialist R&D

Advisor

One draft, limited checks

High

Varies

Manual

May cost extra

Often limited

None until submission

Minimal

Don’t just take our word for it

Trusted by 1,200+ innovative companies

We’ve helped companies across software, life sciences, manufacturing and engineering claim over £260 million with an HMRC enquiry rate at 5%.

"The online platform made it much easier to co-ordinate between the finance and technical teams."

Sophie Meadows

Finance Director, Bloom & Wild

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

Ben Jeffries

CEO & Co-Founder, Influencer

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

Claire Trant

Founder, Untap

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

Aidan Curran

Chief of Staff, Penfold